Crypto spread betting is a popular method for speculating on the price movements of cryptocurrencies, without owning the digital assets themselves. It involves placing bets on whether a cryptocurrency’s price will rise or fall. The key advantage is that individuals can potentially profit from both upward and downward market trends without purchasing the assets.

Traders find crypto spread betting appealing because it allows for leveraged exposure to the market. This means they can control a larger position than the amount of initial capital they invest, which amplifies potential gains. However, it is crucial to remember that leveraging also increases potential losses, making risk management essential.

This form of betting is accessible through various platforms that offer flexibility in terms of trading hours and cryptocurrencies available. It appeals to those who appreciate both the volatility and the returns that can come with trading in the dynamic crypto market. Enthusiasts are drawn to the opportunity to engage with market fluctuations, looking for strategic ways to maximize their profits.

Understanding Crypto Spread Betting

Crypto spread betting is a method of speculating on the price movements of cryptocurrencies without owning the underlying asset. Traders aim to predict whether a specific cryptocurrency will rise or fall in value. This trading approach amplifies potential gains or losses due to its leverage system.

Key Characteristics of Crypto Spread Betting:

- Leverage: Traders can control a large position with a relatively small deposit. This increases both potential profits and risks.

- No Ownership: Unlike traditional trading, individuals do not own the cryptocurrency they are betting on.

- Tax Benefits: In some jurisdictions, profits from spread betting may be tax-free, as it is considered betting, not investing.

Crypto spread betting is popular for its flexibility. Traders can go long if they believe a cryptocurrency will increase in value or short if they anticipate a drop. This allows adaptation to various market conditions swiftly.

Risks Involved:

- Market Volatility: Cryptocurrency markets are known for their rapid price changes, which can lead to significant gains or heavy losses.

- Leverage Risks: While leverage can amplify returns, it also increases the potential for losses beyond the initial stake.

- Complexity: Requires a solid understanding of both the crypto market and the mechanics of spread betting.

Common Strategies:

- Trend Following: Identifying and following trends in the crypto market.

- Range Trading: Trading within a set price range.

- Scalping: Making quick, small trades to take advantage of short-term market movements.

Crypto spread betting offers potential opportunities for those looking to engage in the dynamic world of cryptocurrency trading without owning the digital assets.

How Crypto Spread Betting Works

Crypto spread betting allows traders to speculate on the price movements of cryptocurrencies without owning the assets. It involves predicting whether the price will go up or down and potentially profiting from the accuracy of these predictions. Understanding how spread betting operates, including the roles of companies and how profits or losses are calculated, is integral to using this approach effectively.

The Role of Spread Betting Firms

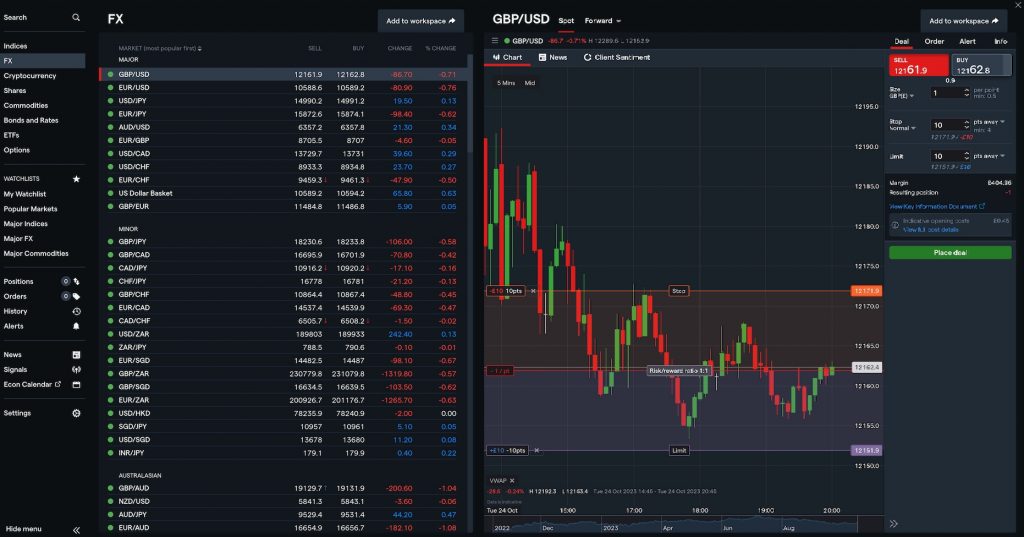

Spread betting firms act as intermediaries, providing access to a wide range of crypto markets. They offer platforms where traders can place their bets on price movements. These firms determine the spread, which is the difference between the buying and selling prices. Spreads allow the firm to earn a profit on trades, acting as their fee for providing the service.

Traders don’t pay commission directly; instead, the cost is built into the spread. Firms also provide leverage, allowing traders to control larger positions with a smaller amount of capital. This feature can amplify potential profits as well as losses. Risk management tools, such as stop-loss orders, are often available to help traders limit potential losses.

Spread Betting Mechanics

In spread betting, individuals decide the amount they want to bet per point change in the cryptocurrency’s price. For example, if a trader bets $10 per point and the market moves 5 points in their favor, they earn $50. Conversely, if the market moves against them by 5 points, they lose $50.

Trading platforms update real-time prices that reflect market conditions and the spread. By using charts, technical analysis, and news updates, traders make informed decisions. Positions can typically be taken on both upward (long) and downward (short) price movements, offering flexibility in strategy regardless of current market trends.

Profit and Loss Calculations

Profits and losses in spread betting are determined by the difference between the opening and closing prices of the bet. Profit is earned when the prediction of movement is correct; losses occur when it’s incorrect. The total amount is calculated by multiplying the point difference by the stake placed per point.

For instance, with a $5 stake per point and a 10-point favorable movement, a trader gains $50. Conversely, a 10-point adverse movement results in a $50 loss. The ease of calculating potential outcomes helps traders make quick decisions, essential in the fast-moving world of cryptocurrencies.

Benefits of Crypto Spread Betting

Crypto spread betting offers unique opportunities for traders, including the use of leverage to amplify potential gains and specific tax benefits that may not apply to other forms of trading. Additionally, the ability to profit from both rising and falling markets makes it an attractive option for those looking to diversify trading strategies.

Leverage and Margin

One of the primary benefits of crypto spread betting is the ability to use leverage. This allows traders to control a larger position with a smaller initial investment, potentially magnifying profits. For example, with 10:1 leverage, an investment of $100 could control $1,000 worth of cryptocurrency positions.

Leverage can be a double-edged sword, though, as it also amplifies the risks. Traders must manage their positions carefully and be aware of potential margin calls. Margin requirements vary by provider and must be understood thoroughly.

Effective risk management strategies can mitigate potential losses. Stop-loss orders and setting predetermined exit points are vital tools for managing trades. Educating oneself about the specific leverage and margin requirements is crucial to avoid unforeseen financial strain.

Tax Advantages

Crypto spread betting may offer tax benefits in certain jurisdictions, making it appealing to traders seeking to optimize their financial outcomes. In some countries, profits from spread betting are exempt from capital gains taxes, compared to traditional trading or investing.

These tax exemptions depend on individual circumstances and local tax laws, which vary widely. Consulting with a tax advisor or financial professional specializing in cryptocurrency may provide clarity and ensure compliance with applicable regulations.

Understanding how specific tax rules apply can help traders maximize their returns. It is crucial to keep records of all trades and consult professionals who are knowledgeable about taxes in the context of crypto trading.

Short Selling Capabilities

Crypto spread betting includes short selling, giving traders the opportunity to profit when the value of a cryptocurrency decreases. This flexibility allows for profit-making in both bullish and bearish market conditions, expanding potential trading opportunities.

Short selling involves speculating on a decline in price. This strategy can hedge other investments or offer potential profits in volatile markets. However, it requires an understanding of market trends and careful analysis to avoid large losses.

The ability to short sell introduces a broader range of strategies for traders. Crafting a balanced approach using both long and short positions can help manage risk and take advantage of various market conditions. Sensible planning and thorough analysis are keys to successful trading.

Risks Involved with Crypto Spread Betting

Crypto spread betting carries notable risks, significant among them are leverage exposure, price fluctuations, and potential issues with counterparties. Understanding these risks is crucial for anyone considering this form of financial activity.

Leverage Risks

Leverage allows traders to control large positions with relatively small amounts of capital. While this can magnify profits, it also significantly increases the potential for losses. If the market moves against a trader’s position, they can lose more than their initial investment.

Real-time monitoring of leverage levels and margin requirements is essential. Brokers often impose strict margin calls, leading to positions being liquidated automatically if they fall below required levels. This underscores the necessity for careful risk management strategies and capital allocation.

Market Volatility

Cryptocurrency markets are inherently volatile, with prices capable of large swings in short periods. This volatility can be exacerbated by small market capitalizations and varied trading volumes across different exchanges. Such conditions can lead to sudden and sharp movements, increasing the risk for traders.

To manage this, traders should employ strategies that limit exposure during uncertain times. Utilizing stop-loss orders and understanding market trends can help navigate situations where rapid price changes occur. This kind of planning is essential to safeguard investments against unpredictable market behavior.

Counterparty Risks

Counterparty risks arise when the entity involved in a spread betting transaction fails to meet their obligations. In crypto spread betting, these risks may be higher compared to traditional assets due to the relatively unregulated nature of many platforms.

This requires thorough due diligence when selecting a platform, focusing on their reputation and financial stability. Traders can mitigate these risks by choosing regulated or well-known brokers that have a track record of reliability and transparency. Furthermore, understanding the terms of service and knowing how their funds are safeguarded can provide additional peace of mind.

Choosing a Spread Betting Platform

Selecting a spread betting platform involves finding a reliable service, evaluating cryptocurrency market availability, and considering the tools and features offered.

Platform Reliability

A key factor is the platform’s reliability, ensuring smooth operations at all times. They should offer robust security measures like two-factor authentication and SSL encryption to protect user data and funds.

Examine the platform’s track record for uptime and responses to potential downtime or technical issues. Consistent updates and clear communication during such events can indicate a trustworthy operation. Customer service availability is vital, preferably 24/7, to address user concerns promptly.

Available Cryptocurrency Markets

When considering a platform, reviewing the range of available cryptocurrency markets is essential. The platform should offer access to both major cryptocurrencies like Bitcoin and Ethereum, as well as smaller, emerging tokens.

A diverse selection allows users to trade according to their strategies and interests. Check if there are restrictions on trading specific cryptocurrencies and if the platform supports the assets you’re interested in.

Tools and Features

Effective tools and features enhance the trading experience. Platforms often provide charting tools, market analysis, and customizable dashboards. These features can help users make informed decisions based on real-time data.

The availability of a demo account can be beneficial for new users to practice without financial risk. Educational resources, such as webinars or tutorials, can further enrich the user experience, making it easier for individuals to navigate the complexities of spread betting.

Strategies for Crypto Spread Betting

Crypto spread betting encompasses techniques like technical analysis, prudent risk management, and hedging to enhance trading performance. Each strategy is crucial for maximizing potential gains while minimizing losses.

Technical Analysis

Technical analysis involves studying price charts and using indicators to predict future price movements. Indicators such as moving averages, RSI, and MACD provide insight into market trends.

Moving averages help identify the overall direction, while RSI can signal overbought or oversold conditions. Traders often use charts like candlestick patterns to spot potential reversals or continuation signals. Chart patterns like head and shoulders or triangles are also commonly analyzed. This data-driven approach assists traders in making informed decisions based on market behavior.

Risk Management

Risk management is essential in crypto spread betting to protect capital. Setting stop-loss orders is crucial to limit potential losses. Traders often risk only a small percentage of their account on each trade, typically 1-2%, to preserve their investment over time.

Position sizing is another key element, ensuring that trades are aligned with risk tolerance and market conditions. By diversifying bets and not relying heavily on one trade, traders can shield themselves from substantial downturns. Effective risk management enables consistent performance, even in volatile market conditions.

Hedging

Hedging strategies help traders reduce potential losses by opening additional positions contrary to their main bets. This involves using short or long positions to offset risks associated with unexpected market moves.

For instance, if a trader is heavily invested in a cryptocurrency, they might open a short position in a related asset to balance potential losses. Options and futures are often used for this purpose. Hedging provides flexibility and can help maintain a stable portfolio despite market volatility, allowing traders to secure profits or minimize detrimental impacts.

Regulation and Legal Considerations

Crypto spread betting raises important legal considerations that vary by region. Regulations can greatly impact the risks and legal obligations of participants, making awareness of these factors crucial.

Jurisdictional Variances

The legality of crypto spread betting varies significantly across different jurisdictions. In the UK, it is regulated by the Financial Conduct Authority (FCA), which imposes strict compliance measures for providers. These include ensuring transparent pricing and maintaining client funds protection.

In the United States, crypto spread betting is largely restricted due to tight regulations under the Commodity Futures Trading Commission (CFTC). Some countries have outright bans due to potential risks. Therefore, participants must fully understand the laws in their specific region and consult local authorities if necessary.

Compliance Issues

Firms offering crypto spread betting need to comply with various regulations to operate legally. They must adhere to anti-money laundering (AML) protocols, ensuring thorough checks to prevent illicit activities. Customer identification and verification procedures are crucial components of compliance.

Regulatory bodies often require firms to maintain detailed records and submit regular reports. Non-compliance can result in severe penalties, including fines or license suspension. Participants should check whether providers are registered and in good standing with their regulatory body to ensure adherence to legal standards.

The Future of Crypto Spread Betting

Crypto spread betting is poised for significant growth, driven by emerging technologies and changing regulations. As blockchain technology enhances transparency, trust in crypto markets is likely to increase. This could attract more participants, eager to explore the potential of spread betting in a digital landscape.

Regulatory frameworks are evolving to provide clearer guidelines for crypto-related activities. With more jurisdictions recognizing the importance of cryptocurrency, policies may align more closely with traditional financial instruments. This alignment can lead to increased institutional participation, offering greater liquidity and diversity in spread betting options.

Technological advancements will further shape the landscape. Enhanced data analytics and AI can offer insights into market trends, potentially enabling more informed betting strategies. As trading platforms integrate these technologies, users could benefit from improved decision-making tools and more personalized experiences.

Crypto spread betting platforms may offer features similar to those in traditional markets but tailored to the unique dynamics of digital currencies. Leveraged trading and a wide range of crypto pairs could become standard offerings, broadening the appeal to various trading styles.

Potential Challenges:

- Market Volatility: Crypto markets remain highly volatile.

- Security Concerns: Protecting against cyber threats is crucial.

- Regulatory Uncertainty: Ongoing changes require adaptability.

The risk-reward ratio and the rapidly changing environment warrant careful consideration. As the sector matures, it’s essential for participants to stay informed about these developments and adapt to new market conditions.